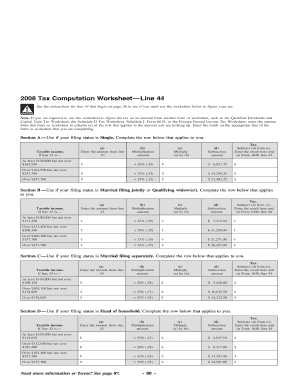

If your taxable income is 100000 or more and you do not have net capital gain or qualified dividends 224 or claim the foreign earned income or housing exclusion 225 you must figure your 2012 regular tax liability on the IRSs Tax Computation Worksheet. Form IT 201-I Tax computation worksheet 9 Before you begin.

The Page Cannot Be Found Budgeting Finance Investing

2012 Tax Computation Worksheet263 2012 Tax Rate Schedules264 Your Rights as a Taxpayer265 How To Get Tax Help266 Index267 Where To File289 The explanations and examples in this publication reflect the interpretation by the Internal Revenue Service IRS of.

2012 tax computation worksheet. RI-1041 TAX COMPUTATION WORKSHEET 2012 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041 line 7 is. 0000 4 0000 4 7500 0000 5000 of taxable net income of excess over 1000 of excess over 2000 of excess over 3000 of excess over 100000 of excess over 125000 of excess over 150000. If Line A is less than 12500.

0 000 a Enter Taxable Income amount from RI-1041 line 7 b Multiplication amount c Multiply a by b d Subtraction amount e Subtract d from c Enter here and on RI-1041 line 8 TAX 57150. If your New York AGI line 33 is more than 300000 but not more than 2000000 and your taxable income line 38 is more than 300000 then you must compute your tax using this worksheet. MUST be removed before printing.

All forms are printable and downloadable. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. If Line A is greater than 12500 25000 if filing status is 2 or 5 enter 12500 25000 if filing status is 2 or 5.

MUST be removed before printing. Ad Download over 20000 K-8 worksheets covering math reading social studies and more. Tax CompuTaTion WorksheeT keep this worksheet for your records a Taxable income.

Date _____ Page 1 of 108 2106 - 18-Jan-2013 The type and rule above prints on all proofs including departmental reproduction proofs. IRD numbers Ng tau IRD. Enter the amount from Form IT-540B-NRA Line 11.

NOL Steps Follow Steps 1 through 5 to figure and use your NOL. KiwiSaver for employers. Form IT 201-I Tax computation worksheet 3 Before you begin.

WORKSHEET NR-3 2012 NET PROFITS TAX RETURN Computation of apportionment factors to be applied to apportionable net income of certain nonresidents of Philadelphia. Tax laws enacted by Congress. Total average value of Philadelphia property from Column A Line 6 above.

Local tax See Instruction 19 for tax rates and worksheet Multiply line 21 by your local tax rate__ __ __ __ or use the Local Tax Worksheet. The Tax Computation Worksheet provides the same amount of tax as the IRS tax rate schedules. If your New York AGI line 33 is more than 100000 but not more than 2000000 and your taxable income line 38 is 150000 or less then you must compute your tax using this worksheet.

Discover learning games guided lessons and other interactive activities for children. A year beginning in 2012. Jan 18 2013 Cat.

Discover learning games guided lessons and other interactive activities for children. Manufacturing and Selling Square Footage Business Tax Computation Worksheet. Form IT 201-I Tax computation worksheet 1 Before you begin.

When this book went to press the Tax Computation Worksheet was not available. 12202012 22952 PM. A 00 B First Bracket.

Local earned income credit from Local Earned Income Credit Worksheet in Instruction 19. Non-profits and charities Ng umanga kore-huamoni me ng umanga aroha. Use this Worksheet for both Tax Computation Worksheet and Tax Table no need to manually search the long and fine printed tax table.

Income tax Tke moni whiwhi m ng pakihi. Once completed you can sign your fillable form or send for signing. 0 000 a Enter Taxable Income amount from RI-1041 line 7 b Multiplication amount c Multiply a by b d Subtraction amount e Subtract d from c Enter here and on RI-1041 line 8 TAX 57150 218226 57150.

Form 1040 Tax Computation Worksheet 2018 Line 11a On average this form takes 13 minutes to complete. You may have an NOL if a negative figure ap-pears on the line below. Goods and services tax GST Tke m ng rawa me ng ratonga.

If your New York AGI line 33 is more than 250000 but not more than 1500000 and your taxable income line 38 is more than 250000 then you must compute your tax using this worksheet. IonsI10402012AXMLCycle10source 2106 - 18-Jan-2013 The type and rule above prints on all proofs including departmental reproduction proofs. 2012 Tax TableContinued If line 43 taxable income is And you are At least But less than Single Married filing jointly Married filing sepa- rately.

2012 Federal Tax Before you begin. 24811V 1040 INSTRUCTIONS 2012 Geta fasterrefund reduce errors and save paper. The Form 1040 Tax Computation Worksheet 2018 form is 1 page long and contains.

Tax Return Application for Tentative Refund See How To Get Tax Help near the end of this publication for information about getting these forms. If ALL of your business activity is conducted solely within Seattle all deliveries or services are delivered within Seattle or if you are reporting under the old code. Page 80 of 108 Fileid.

2012 NPT Worksheets P4 11-16-2012 Computation of Apportionment Factors. A year beginning in 2012. Complete your tax return for the year.

RI-1041 TAX COMPUTATION WORKSHEET 2012 BANKRUPTCY ESTATES use this schedule If Taxable Income-RI-1041 line 7 is.

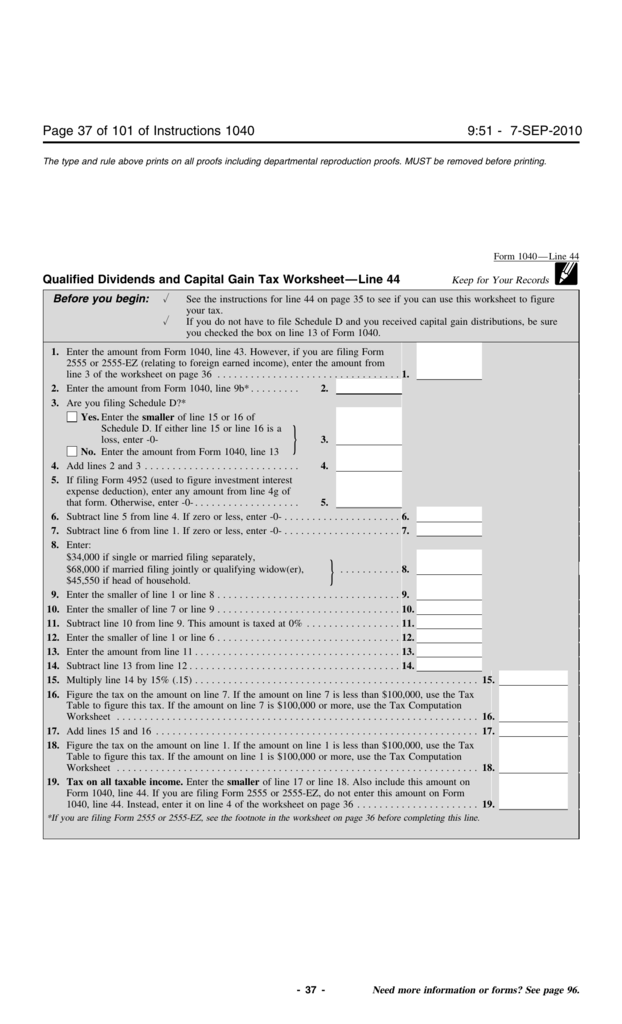

Qualified Dividends And Capital Gains Worksheet

Https Assets Ctfassets Net Lrqh3qmw9nn5 350arrdd8y2jk2mfmvnfrs D7782ef6fa57b13605a53528fe93f197 Elizabeth Warren 2020 Tax Return Pdf

Qualified Dividends And Capital Gain Tax Worksheet Line 44

Tax On Esops Tax Income Tax Market Value

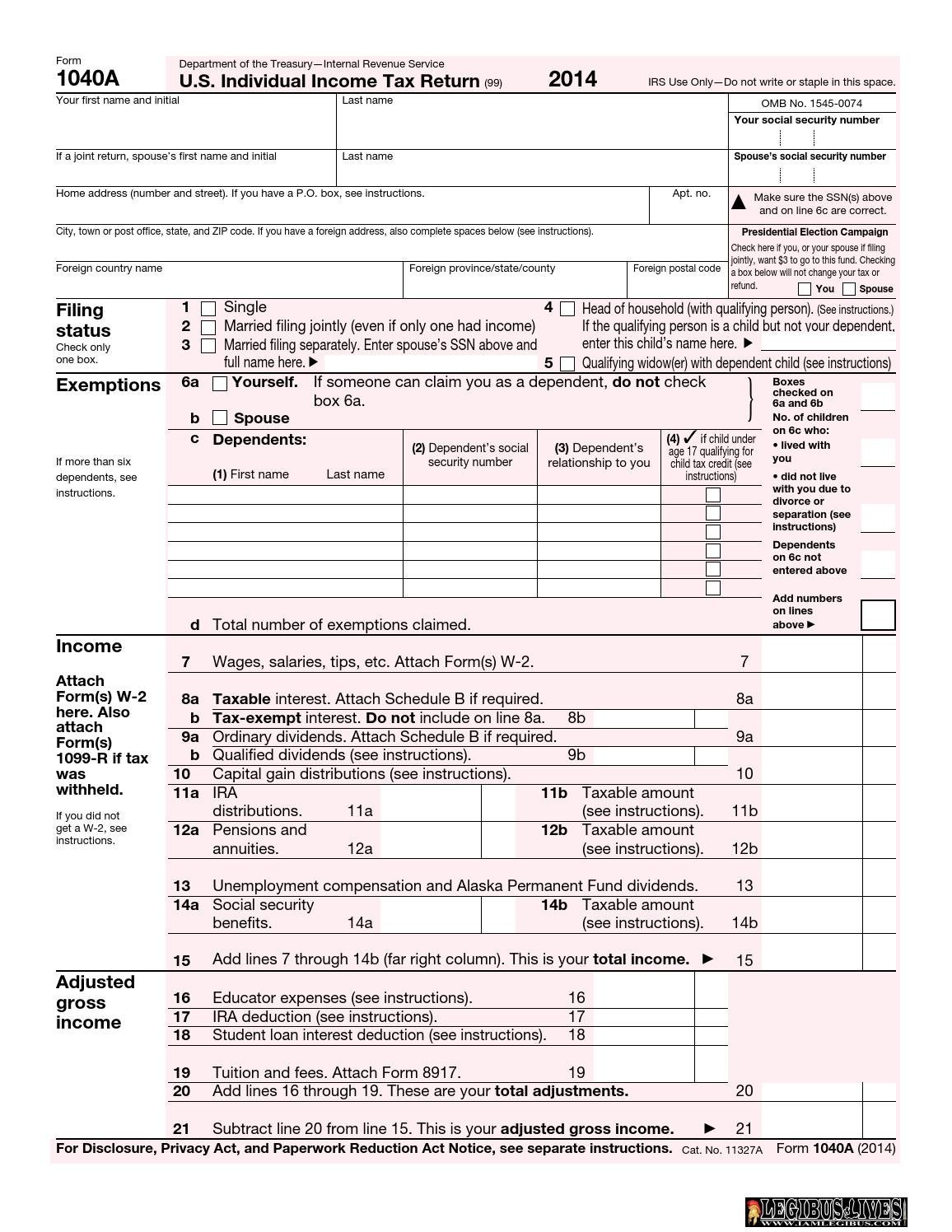

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Importance Of Pan Number Account Number Savings Bank Income Tax

Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Budget Template

Foreign Earned Income Tax Worksheet 2020 Fill Online Printable Fillable Blank Pdffiller

The Go Curry Cracker 2018 Taxes Go Curry Cracker

2012 Tax Computation Worksheet Fill Online Printable Fillable Blank Pdffiller

Tax Computation Worksheet Fill Online Printable Fillable Blank Pdffiller

Http Revenue Louisiana Gov Vendorforms It540bnrai 1 12 F Pdf

E Filing Home Page Income Tax Department Government Of India Financial Management Income Tax Income

U S Individual Income Tax Return Forms Instructions Tax Table F1040a I1040a I1040tt By Legibus Inc Issuu

2011 Form Irs Instruction 1040 Line 44 Fill Online Printable Fillable Blank Pdffiller

Index Of Wp Content Uploads 2018 09

Features Of Debt Mutual Funds Mutuals Funds Investing Fund

Ambedkar Action Alert How Will The Budget Impact On You Budgeting Impact Income Tax

No comments:

Post a Comment